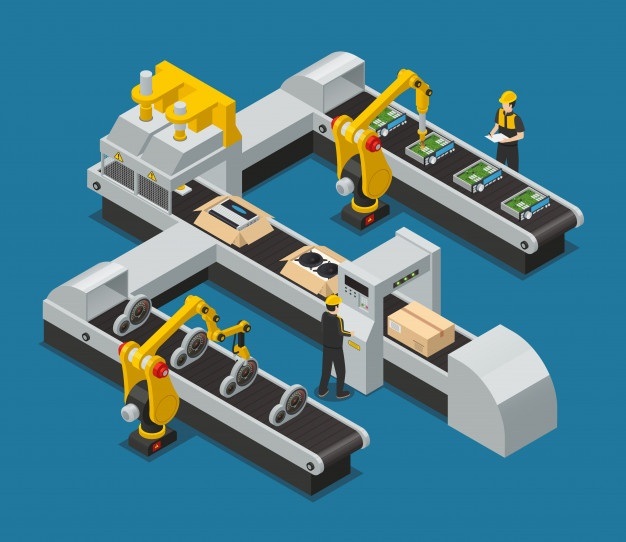

Conveyor systems offer efficiency and safety in transportation options for scores of industries. This involves services in numerous areas such as aerospace manufacturing, canning, bottling, and chemicals among others. On many occasions, conveyor systems are in different sizes in order to fit all the firm schemes.

It is, therefore, important that you consider such features in order to get the ones that suit your specific needs. With a conveyor system, industries are able to have well-organized and effective operations. They are fast reliable and reduce excessive human labor within the industries.

This article lists various things you need to know about top-of-the-line conveyor systems.

Contents

Check For Quality :

To get a good conveyor system, one must consider doing thorough research prior to the acquisition. This is by selecting the best company that you trust and is with a good reputation in terms of manufacturing. We all want something that will give us long-term service without frequent breakdowns. In that case, if you experience any technicalities, the change part company will provide you with experienced personnel to repair it on your behalf. This will ensure an accurate repair with fewer faults.

Size And Design :

One should be careful when considering the size of a conveyor system. In most cases, it is not always that the bigger or smaller ones are the ones with great services. The best thing to do is consider the amount of space available to fit your conveyor system. From there now you can decide on what size to purchase. Among the few factors to consider are the floor space, the ceiling height, and other factors that might cause interferences during installations.

The Work Environment Matters :

The conveyor system placement can also be influenced by one work environment. Among the few things that might be affecting this is what that particular company is dealing with. This includes either the open ignition sources or the explosions. A wrong choice of equipment can only lead to unwanted accidents thus it’s Important if one chooses wisely.

Profitability :

One must know what suits his company before settling for a conveyor system. This can, in turn, benefit a company vastly in terms of profitability. So, if you can know your needs prior to the acquisition, then the better. This is because, aside from just getting the best conveyor system, you will also save a lot and be able to enhance your company’s profitability.

Accuracy :

Accuracy is one thing you must consider in your conveyor system. An accurate system will not only ensure smooth and consistent in your work processes but also provide fast and reliable service. For instance, you might be applying labels, and for a good end result, there must be accurate. For that matter, you are able to save on a lot in the long run.

Service And Maintenance

Considering the service and maintenance of your system can be very important for numerous reasons. This is possible to reduce the level of breakdowns and ensure smooth operations. In the process, it can be easier to prevent expensive maintenance processes. Thus, you can save much on repair issues.

In conclusion, the conveyor systems can add safety to facilities. This is, however, if they are made carefully to meet the company’s needs. It is, therefore, important if you take the time to pick the one that suits your needs for better profitability. With these few tips, you are able to get the best conveyor system if you implement them wisely.

Read Also :